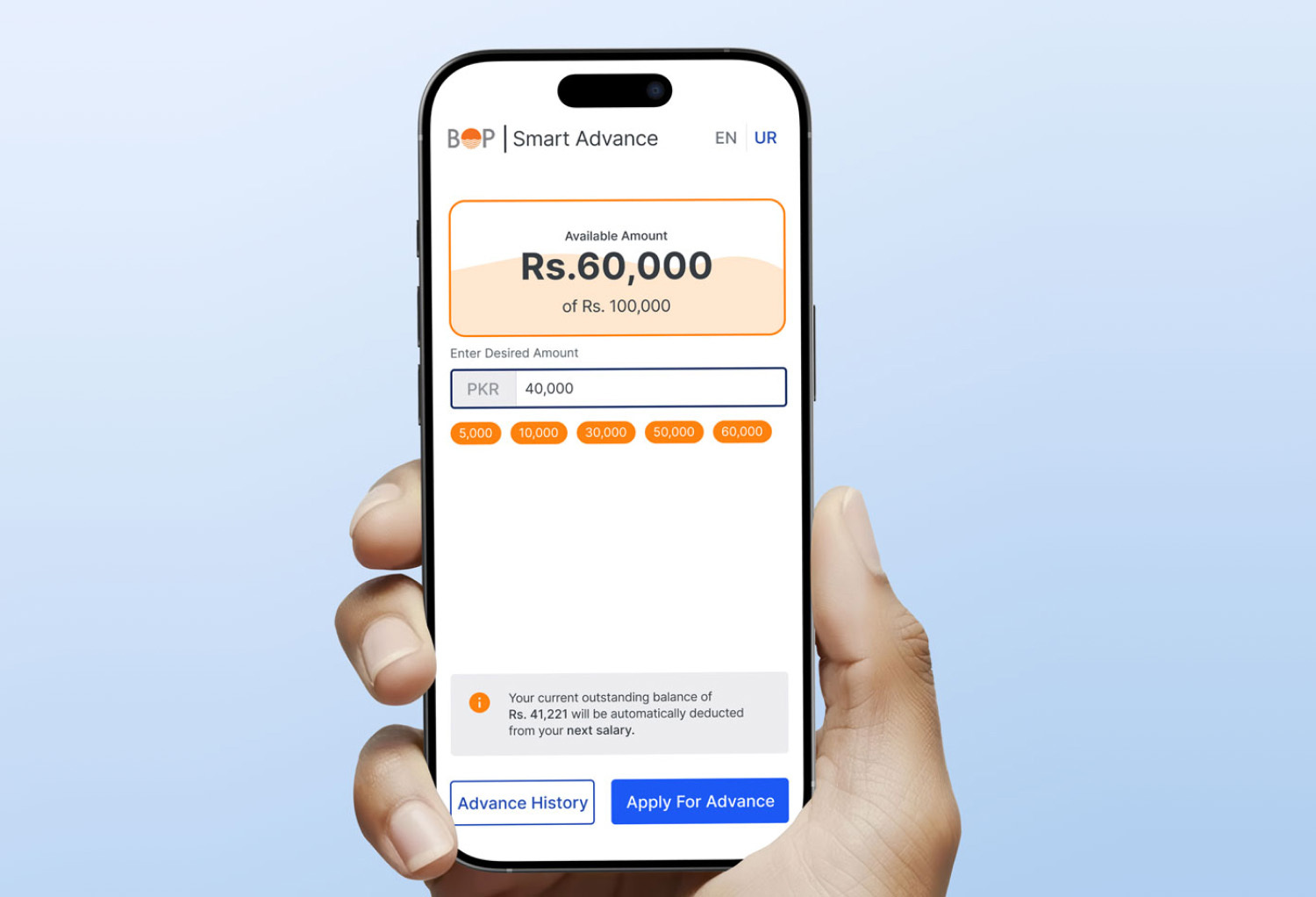

Outcome

By combining data with empathy, we created an experience that not only improved the interface—but addressed deeper behavioural and emotional barriers around borrowing.

The result? A faster, more intuitive, and human-centric lending journey—one that users could trust.

The result? A faster, more intuitive, and human-centric lending journey—one that users could trust.