HBL

Designing for Pakistan’s leading financial institution

Services

Service Design, Ethnography

Industry

Financial institutions

Encouraging Digital Adoption at HBL

HBL, Pakistan’s largest financial institution, serves over 20 million customers through a network of 1,700+ branches. Despite offering digital banking services, a significant number of customers continued to visit physical branches for routine transactions.

Our Role

To optimize costs and improve accessibility, HBL partnered with Designist to understand why customers preferred in-branch transactions and how to encourage a smooth transition to digital banking for low-risk routine transactions.

Understanding the Customer Mindset

Our research focused on understanding user behavior, banking habits, and service inefficiencies for the 7 core financial and non-financial transactions selected, including fund transfers, bill payments, and balance inquiries.

Our field research took us to branches across Karachi, Lahore and Islamabad to identify different insights that helped us completely understand these 7 transactions.

The over 200 customer interviews helped generate data essential in building detailed customer journeys, and understanding their banking habits, recurring transactions, misgiving about going digital, and experience with branch banking.

The service provider experience through engaging branch employees helped understand transaction handling and service variations across branches that could be contributing to the existing customer preferences.

By mapping customer behaviors and service touchpoints, we uncovered the barriers preventing digital adoption.

Our field research took us to branches across Karachi, Lahore and Islamabad to identify different insights that helped us completely understand these 7 transactions.

The over 200 customer interviews helped generate data essential in building detailed customer journeys, and understanding their banking habits, recurring transactions, misgiving about going digital, and experience with branch banking.

The service provider experience through engaging branch employees helped understand transaction handling and service variations across branches that could be contributing to the existing customer preferences.

By mapping customer behaviors and service touchpoints, we uncovered the barriers preventing digital adoption.

Mapping the Experience

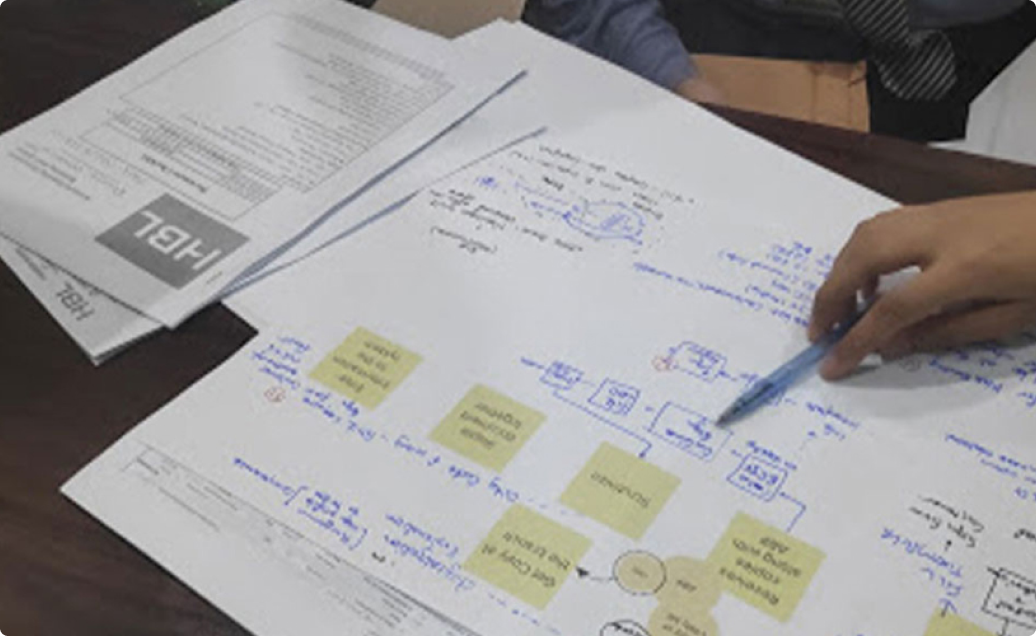

Customer journey maps created for all 7 transactions helped us identify the friction and pain points that occur for the customer, at each stage of their experience with HBL’s service, and laid the foundation for ideating solutions for these pain points.

The journey maps covered not only the steps and time taken but went beyond by mapping the customers’ emotional and cognitive load throughout and the perceived bank support that defined the intangible experiences and drove customer preference for in-person banking.

The journey maps covered not only the steps and time taken but went beyond by mapping the customers’ emotional and cognitive load throughout and the perceived bank support that defined the intangible experiences and drove customer preference for in-person banking.

Artifacts Study

Designist also conducted an in-depth study into the various artifacts that had to be utilised by the service user and service provider – with the different approaches build our process recommendations.

During this period, it was also noted how each branch had a different mechanism to solve for common recurring issues.

During this period, it was also noted how each branch had a different mechanism to solve for common recurring issues.

Co-Creation & Recommendations

To translate insights into action, Designist led a three-day co-creation session with HBL stakeholders, bringing together branch managers, customer service teams, and digital banking representatives.

Through these sessions, we:

Through these sessions, we:

- - Developed targeted communication strategies to build customer trust in digital banking.

- - Recommended enhancements to digital banking platforms to improve usability and accessibility.

The Outcome

By implementing these data-driven improvements, HBL was able to streamline service delivery, enhance customer experience, and drive digital adoption.

HBL was enabled to launch a Channel Migration agenda, driving customers towards digital channels with incentives and support. This initiative resulted in continued and rapid growth in digital transactions, strengthening HBL’s digital-first approach and significantly reducing costs.

HBL was enabled to launch a Channel Migration agenda, driving customers towards digital channels with incentives and support. This initiative resulted in continued and rapid growth in digital transactions, strengthening HBL’s digital-first approach and significantly reducing costs.